Corporate education and training continues to evolve with the availability of multiple training modes including e-Learning, instructor-led webinars, instructor-led classroom workshops, instructor-led simulation events and m-Learning.

This range of training mode options has created uncertainty for our clients about the training mode or blended program to prioritize. This is especially true when taking into account budget considerations.

It is clear that the landscape for executive education and training is rapidly evolving, influenced by budget constraints, pandemic-related changes, and technological advancements. In response to client uncertainty the analysis below outlines the pros and cons of the different training modes to help clients prioritize and optimize their training solution, especially for large organizations.

INSTRUCTOR-LED WEBINARS

PROS

- Scalable for large audiences

- Minimal logistical planning

- Easily recorded for future reference

CONS

- Reduced engagement with trainees

- Lack of hands-on activities

- Limited networking opportunities

INSTRUCTOR-LED WORKSHOPS

PROS

- High engagement

- Immediate feedback

- Networking and team-building

CONS

- Costly (venue, travel)

- Budget constraints

- Less scalable for large groups

E-LEARNING

PROS

- Interactive & engaging

- Flexible timing

- Moderate scalability

CONS

- Requires reliable internet & hardware

- Less effective for complex topics

- Requires strong self-discipline

MICRO-LEARNING MODULES

PROS

- Easily digestible content

- Highly flexible

- Good as refresher or cross-skilling

CONS

- Often lacks depth

- Less suitable for complex subjects

- Fast in, fast out

INSTRUCTOR-LED SIMULATION EVENTS (Learning-by-doing)

PROS

- Helps retain previous learning

- High interaction with peers

- Competitive environment

CONS

- High cost (venue, travel)

- Pre-learning essential

- Only for high achievers

Recommendations for large organizations:

1. Absolutely prioritize:

Given scalability and minimal logistical requirements, instructor-led webinars and e-Learning should be the go-to options.

2. Mix-and-match optimization:

- Use instructor–led classroom workshops for specialized skills and team-building activities.

- Integrate e-Learning to provide standard reskilling and upskilling activities and to build a common way of working and vocabulary across the organization.

- Integrate m-Learning modules as ongoing skill refreshers or cross-skilling.

In conclusion, a blended approach that capitalizes on the strengths of each format will likely offer the most robust and flexible training solution for large organizations.

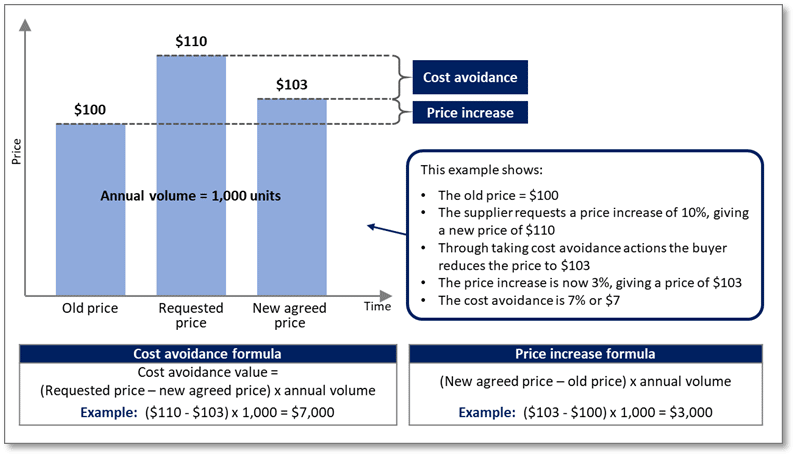

An effective supplier performance measurement process can create a virtuous customer cycle. Without it numerous unacceptable outcomes can result for the buying organization and its customers, including: increased prices, disrupted supply, higher risk, poorer quality, etc.

An effective supplier performance measurement process can create a virtuous customer cycle. Without it numerous unacceptable outcomes can result for the buying organization and its customers, including: increased prices, disrupted supply, higher risk, poorer quality, etc.